The selection of what group of time frames to use is unique to each individual trader. We tend to see the predominant trend using a higher time frame than what we intend to use to select positions, and we tend to use a lower time frame to actually enter the trade, hence the term “multiple time frame trading”. EMA-4-MTF-Strategy take this approach into account for the best trading outcomes. It is not out of the ordinary for a currency pair to be in a primary uptrend while being mired in intermediate and short-term downtrends. As such, there can be conflicting trends within a particular currency depending on the time frame being considered. However, markets exist in several time frames simultaneously. Trends can be classified as primary, intermediate and short term. The "O?" could be convert when you think pips are enough at this point.Įntry: preferred when Bars crosses EMA 9 and close on counterpart (or 9/20 crossover).Įxit: could be with EMA9/20 intersection. You see even a more general picture if you watch the moving price averages on higher time frames. Price data can change very much from every day and still conceal if the price is growing or decreasing.

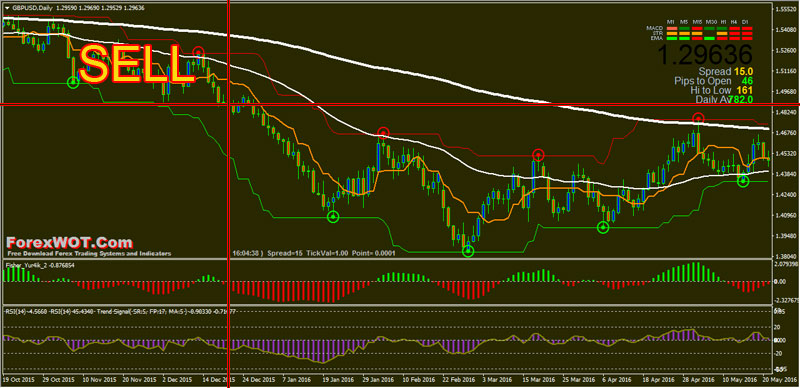

GBP/JPY will have an average daily range around 120 – 170 pips, so you do better setting on 5 min or 15 min chart, instead of a 1 min chart. (d) trading different currencies with multiple time frames. (c) trading different currencies with the same time frame. (b) trading the same currency with multiple timeframes (a) trading the same currency with one time frame The "O?" markers are close matched points adequate for making serveral bips. When market trades sideways (not trending) with little fluctuation in price it can give on higher timeframes false signals, so it is not suggested to use it during such period with TF > 15 min. So it can change its signals any time, second – you need to watch it all the time. It does not predict the future market directions, but rather reflects current situation on the market. It is easy to use and gives very good results exceedingly when the market is trending, during big price break-outs and big price moves. There are no seconds doubts acting now or waiting a bit longer!ĥ5 EMA, 120 EMA, 200 EMA indicate more the global trend and gives psychologically speaking orientation, when EMA 9 getting vulnerable to sideways shoppy prices.ĮMA's don't extend in the future, they can only follow market price.ĮMA-4-MTF Trading Strategy based on fast moving averages are quite easy to follow. with some co-occuring entry and exit-points (O/E)ĩ EMA entry works on any time frame, waiting untill the price bar closes above 9 EMA to enter long or below 9 EMA to go short.ĮMA9 crosses EMA20 indicate confirmation that you're trading an infinite deal more with the trend, but it's not necessary, even though you could deal with it. Indicators see p.4, #34 (without EMA 200), (Higher risc: when bar crosses EMA 9 and closes at counterpart side) Time Frame: 10 sec., 30 sec., 1 min., 5min., 15 min., 30 min., 1h, 3h, 4h, 1 day, 1 weekĮxception of the rule: 10 sec TF - only EUR/USD (with Spread ~1.5)

Exponential Moving Average For Multiple Time Frame

0 kommentar(er)

0 kommentar(er)